October 1, 2015 was a bittersweet day in Oregon. Cannabis fans across the state celebrated as limited recreational marijuana sales began in Oregon. It was a truly historic day, and one that I’m sure many cannabis fans will never forget. But, sadly, the day will also be remembered as one of the most tragic days in Oregon history, as a heartless coward killed several innocent people at Umpqua Community College in Roseburg, Oregon on October 1st too.

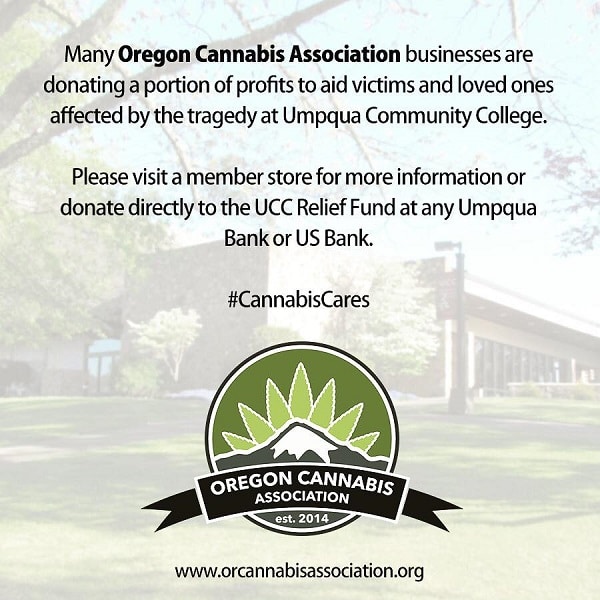

A lot of people made a lot of money on October 1st in the cannabis community, and I’m sure they have made quite a bit of money since that time too. Immediately when I learned of the tragedy in Roseburg I instantly thought that the cannabis community should do something to step up and support the victims of this tragedy. I’m happy to say that the Oregon Cannabis Association was thinking the same thing, and they setup a fund at Umpqua Bank and US Bank that people can donate to. Below is an image that describes the effort, via the Oregon Cannabis Association. I urge all TWB readers to support it, whether you own a cannabis business or not, or if you live in Oregon or not: